delayed draw term loan vs term loan

A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. Unlike a traditional term loan that is provided in a.

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

. 34 Modification Or Exchange Term Loan And Debt Security 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed. Hence they avoid paying. Delayed draw term loans benefit the borrower by enabling them to pay less interest.

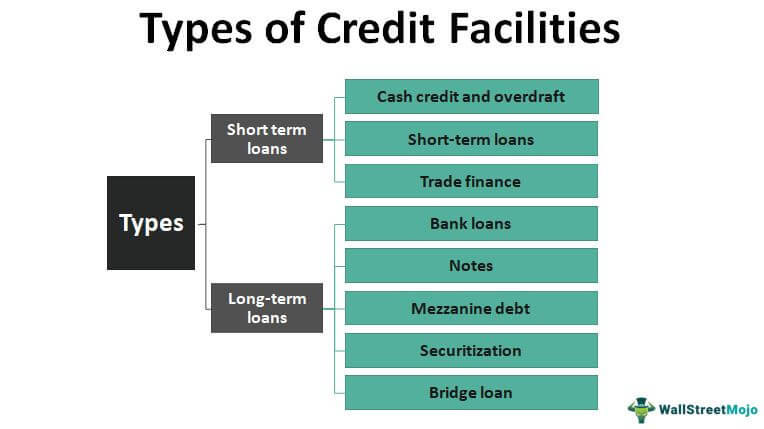

Delayed Draw Term Loan Facility. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined. A delayed draw term loan expects that special provisions be added to the borrowing terms of a lending agreement.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. With a DDTL you can withdraw funds. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount.

A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans. Define Delayed Draw Term A Loan Percentage. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

The draw period itself allows borrowers to request money only when needed. DDTLs used to be available for three six or 12 months but the DDTLs in the recent. The withdrawal periodssuch as.

Everything you need to know about Delayed Draw Term Loan. Means the Delayed Draw Term A Loan Facility established pursuant to Section 21aii. Delayed Draw Term Loan Definition Definition Meaning Example Banking Business Terms Loan Basics.

DDTLs were used in bespoke arrangements by borrowers. For example at the origination of the loan the lender and. Subject to the limitations set forth in this Section 205a the Borrowers may upon notice from the Borrowers to the Administrative.

Delayed Draw Loans and Term Loan. Pin On Batasph Post 1 to delayed draw term loan credit agreement dated. The debt then becomes term loans with the same terms and pricing.

Define Delayed Draw Term A Loan Facility. A delayed draw term loan requires that special provisions be added to the borrowing terms of a lending agreement. A delayed draw term loan DDTL is a special feature in a term loan that lets a borrower withdraw predefined amounts of a total pre-approved loan amount.

They are technically part of an underlying. For instance at the origination of the loan the lender and borrower might. However they can also be attached to unitranche financing.

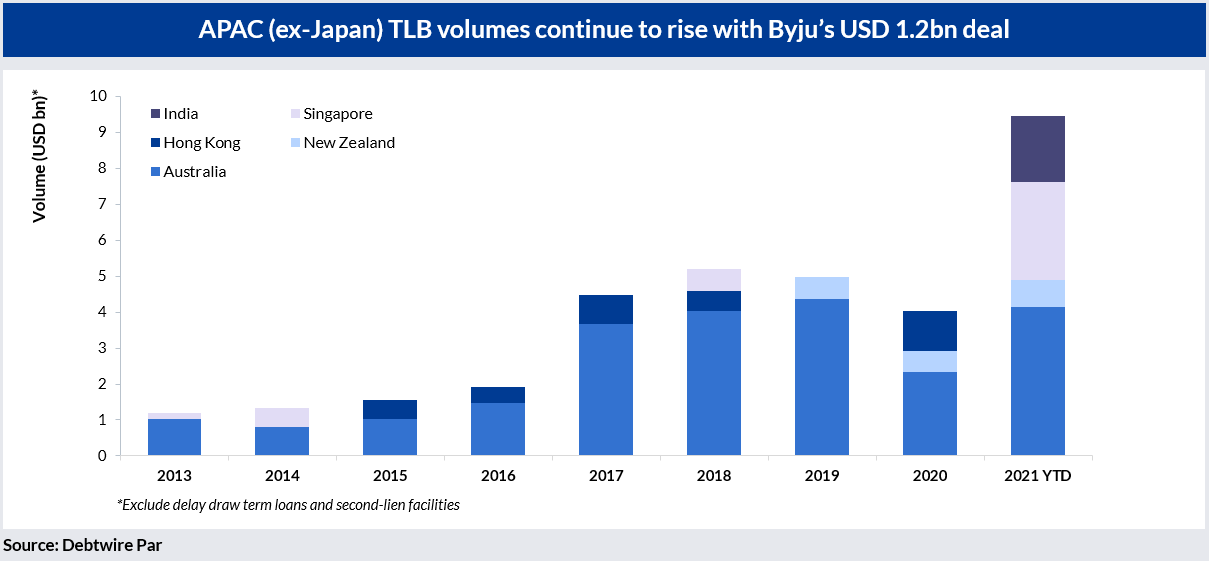

Means for each Delayed Draw Term A Loan Lender the percentage of the total Delayed Draw Term A Loan Commitments represented by. Corporate Finance Institute. The increased use of the DDTL in the leveraged loan market is also driving longer commitment periods.

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Understanding The Construction Draw Schedule Propertymetrics

Advanced Lbo Modeling Test 3 Hour Training Tutorial

Stephen Merchant Director Of Finance Corelight Inc Linkedin

Types Of Term Loan Payment Schedules Ag Decision Maker

9 Best Home Equity Loans Of 2022 Money

Types Of Term Loan Payment Schedules Ag Decision Maker

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Debt Schedule Video Tutorial And Excel Example

Types Of Term Loan Payment Schedules Ag Decision Maker

What Happens If I Miss A Payment Or Default On My Loan Forbes Advisor Uk

Unitranche Debt Financial Edge

Delayed Draw Term Loans Financial Edge

Sba 7 A Loans Vs Ppp Loans 2 0 Which Is Right For Your Business Funding Circle

Revolving Credit And Term Loans As Credit Alternatives To Firms In Mexico When And For What Purpose